El Application Form Cbic

APPLICATION FORM FOR EARNED LEAVE OR EXTENSION OF LEAVE. CBIC Jobs 2021 10 Greaser Seaman Posts Salary Application Form cbicgovin.

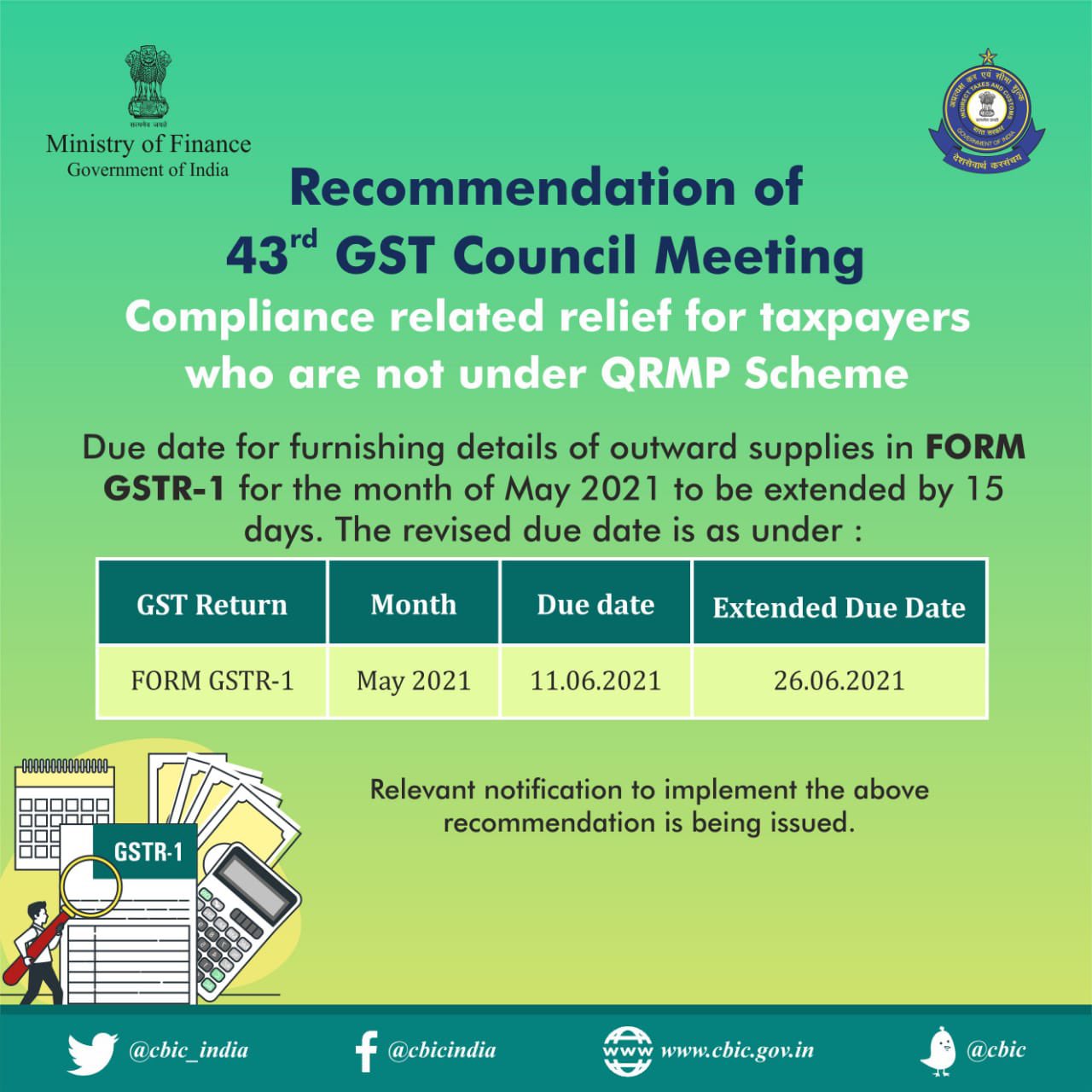

Cbic On Twitter Recommendations Of 43rd Gst Council Meeting 7 Compliance Related Relief For Taxpayers Who Are Not Under Qrmp Scheme Unitedtofightcorona Gst Https T Co Kzftoetmru Twitter

List of Holidays during the Year 2019 for Administrative Offices of.

El application form cbic. April 11 2015 by. Officers Area Miscellaneous. Online training on Anti-Profiteering in GST on 24th August 2021 from 1030 AM to 0105 PMClick here.

I understand that if I become full-time employed again or do not meet any of the above requirements and would like to become a CIC again I must re-apply pay for and pass the initial CIC examination. FormsApplications for Official use. THE APPLICATION PROCESS An applicant for citizenship must fulfil the personal requirements established under the Grenada Citizenship by Investment Act 2013.

Due to COVID-19 appointment availablity at testing centers may be limited. As per the Allocation of Business Rules the Directorate is the Government Printer and responsible for executing printing works for all MinistriesDepartments of Government of India including forms for Civil and Defence Departments. Earned LeaveCommuted Leave 7.

The Directorate of Printing is an attached office of Ministry of Urban Development. I understand that I am required to notify CBIC if I become full-time employed again and will no longer meet the requirements for Emeritus Status. Form of reportapplication for permission to the prescribed authority for the building of or addition to a house.

- 6 46 KB Form of An Application to the High Court under Section 130A of Customs Act 1962. FormsApplications for Official use. CGHS approved private hospitals City wise list.

The officials of the Central Board of Indirect Taxes Customs CBIC has announced the Latest CBIC Job Vacancies 2021 for Group C Posts in Customs Marine Wing in the jurisdiction of Customs Gujarat Zone includes the State of Gujarat and UT. - 6 46 KB Form of An Application to the High Court under Section 130A of Customs Act 1962. Click the link below to view the file Earned Leave Form File Reference Number Earned Leave Form File Date - - EL20Formpdf.

House Rent and other Compensatory allowances drawn in the present post. 38 rows Form of Application for Final Payment in the CPFGPF Account. Departmental Guest house.

FormsApplications for Official use. Of Daman and Diu. A-IPC Online Application No paper applications are available for the a-IPC exam.

Nature and period of leave. Due to the scheduled maintenance activity the ECCS application shall not be functional from 10 pm on 15th August to 4 pm on 16th August Observance of Swachhta Pakhwada campaign from 16th August 2021 to 31st August 2021Click here. Form for giving intimation or seeking previous sanction under Rule 18 3 of the CCS Conduct Rules 1964 for transaction in respect of movable property.

We encourage candidates to visit Prometrics Test Center Openings and Test Center Closures pages to see if. Among other things this means that he or she must be at least eighteen years old have no criminal record be in good health and be willing to make the required contribution. Interested candidates after checking the CBIC.

CA- 5 272 KB Form of Appeal or Application to Appellate Tribunal under sub-section 2 section 129A or sub-section 4 of section 129D of the Customs Act 1962. CIC Initial Applicants and a-IPC Applicants please be aware prior to applying. Name of applicant.

Department Office and Section. I understand that. Number of Days date from which the leave required Number of Days.

All the interested and eligible candidates can download the application form from the official website or link given below and submit the duly filled in and signed application along with required documents in both E-mails and by post on or before last date The e-mail address for sending applications through e-mail. CA- 5 272 KB Form of Appeal or Application to Appellate Tribunal under sub-section 2 section 129A or sub-section 4 of section 129D of the Customs Act 1962. FORM II.

Application for CIC. 15 th day of June 2020 in over 500 CGST and Customs offices across India in the presence of over 800 senior officers of CBIC. The e-Office is a Mission Mode Project MMP under the National e-Governance of India Chairman of Central Board of Indirect Taxes and Customs CBIC has launched remotely the e-Office application today ie.

The Central Board of Indirect Taxes and Customs CBIC has enabled the online filing of application form GST EWB 05 by the Taxpayer for un-blocking of the E-Way Bill generation facility. Visit the career section of CBIC Notification at wwwcbicgovin for. Please verify the details of Age Limit Qualification Application Form Exam Date Admit Card Result Last Date etc.

Earned Leave Form. Form of Statement of Immovable Property. You can get the link of CBIC Job Notification Application Form from the bottom of this page.

A Mutation Based Method For Pinpointing A Dna N6 Methyladenine Methyltransferase Modification Site At Single Base Resolution Cheng 2021 Chembiochem Wiley Online Library

Cbic On Twitter Press Release Late Fee Capped At Rs 500 For Each Gstr 3b Return Nsitharaman Nsitharamanoffc Finminindia Ianuragthakur Https T Co Ngxlbzpq8c

Cbic On Twitter Recommendations Of 43rd Gst Council Meeting 7 Compliance Related Relief For Taxpayers Who Are Not Under Qrmp Scheme Unitedtofightcorona Gst Https T Co Kzftoetmru Twitter

Cbic On Twitter Government To Roll Out Facility To File Nil Form Gstr 1 Through Sms From The First Week Of July Nsitharaman Finminindia Ianuragthakur Https T Co Tp0y4aglqx

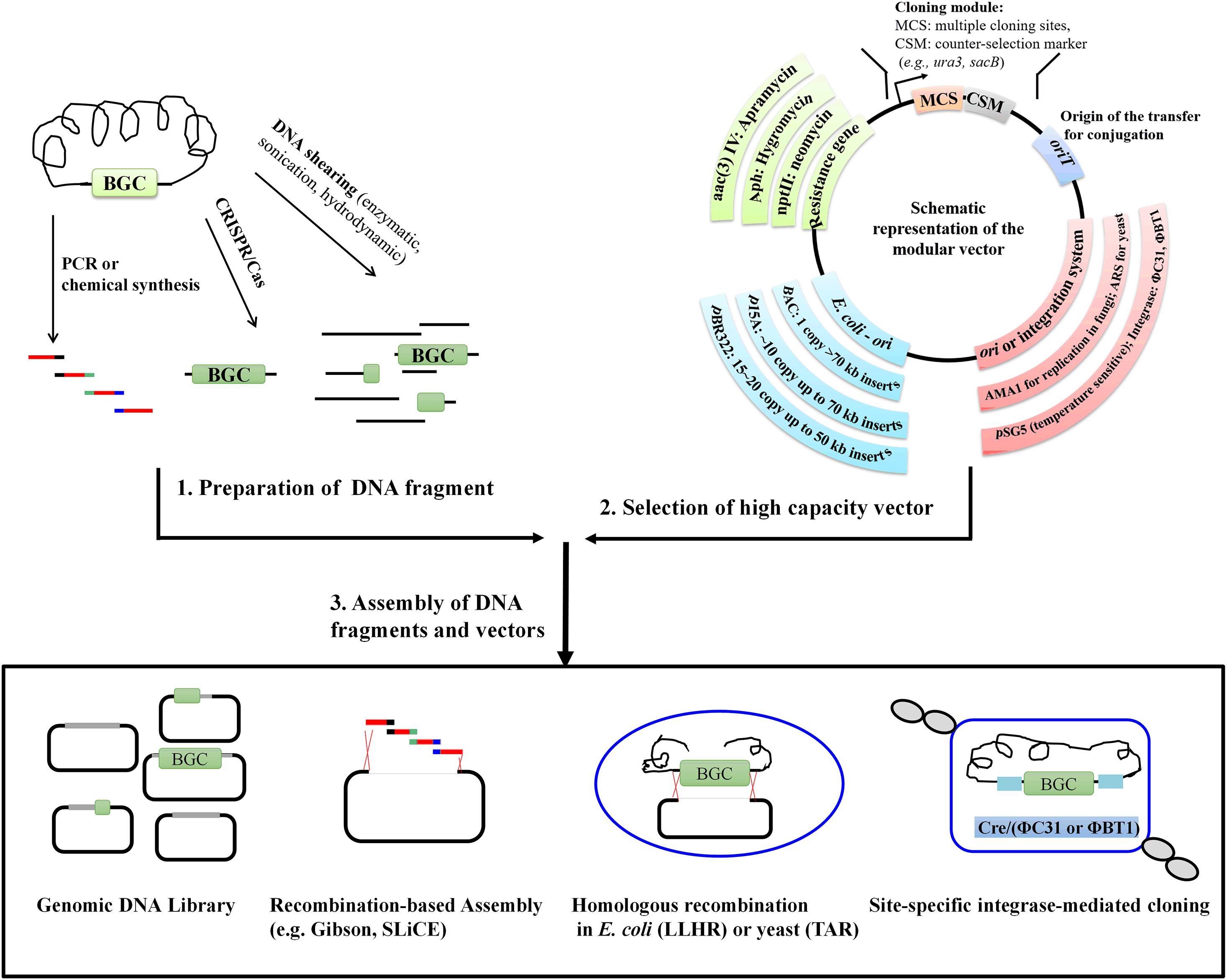

Frontiers Recent Advances In Strategies For The Cloning Of Natural Product Biosynthetic Gene Clusters Bioengineering And Biotechnology

Circular Nucleic Acids Discovery Functions And Applications Li 2020 Chembiochem Wiley Online Library

Cbic On Twitter Relief For Gst Taxpayers Gst Amnesty Scheme For Taxpayers Who Could Not Furnish Return In Form Gstr 3b For Tax Period Of July 2017 To April 2021 Has Been Extended

Cbic On Twitter Recommendations Of 43rd Gst Council Meeting 2 Rationalisation Of Late Fee Leviable On Account Of Delay In Furnishing Return In Form Gstr 3b And Form Gstr 1 For Prospective Tax Period

Cbic On Twitter Taxpayers Please Note That Maximum Late Fee For Form Gstr 3b Has Been Capped At Rs 500 For Taxperiod July 2017 To July 2020 Subject To Returns Being Filed

Cbic On Twitter A Fake Tweet Is Circulating There Is No Extension In Due Dates For Form Gstr 9 And Form Gstr 9c For Fy 2017 18 Taxpayers Are Advised To Ignore Such Misinformation Https T Co J9tkxkis1n

Posting Komentar untuk "El Application Form Cbic"